Maximize the adoption of the digital world with a platform adapted to banking and insurance

Batch’s clients include traditional or pure-player banking and insurance stakeholders who rely on our platform and our teams to maximize customer engagement and digitize their journeys.

Leaders in banking and insurance place their trust in us

CRM designed for how you use it

Provide seamless customer journeys

From first contact to subscription, the customer journey must be smooth, regardless of the contact channel.

Opt for Mobile-First uses

Payment of invoices, instant and secure transfers, subscription to new contracts, and so on. Make sure that your products and services are easily accessible and consumable on a mobile!

Foster self-care

Give your customers the autonomy they deserve, and easily showcase your services and the features of your app to encourage their use.

Be RGPD-compliant

Batch meets all regulatory requirements.

Increase your digital sales

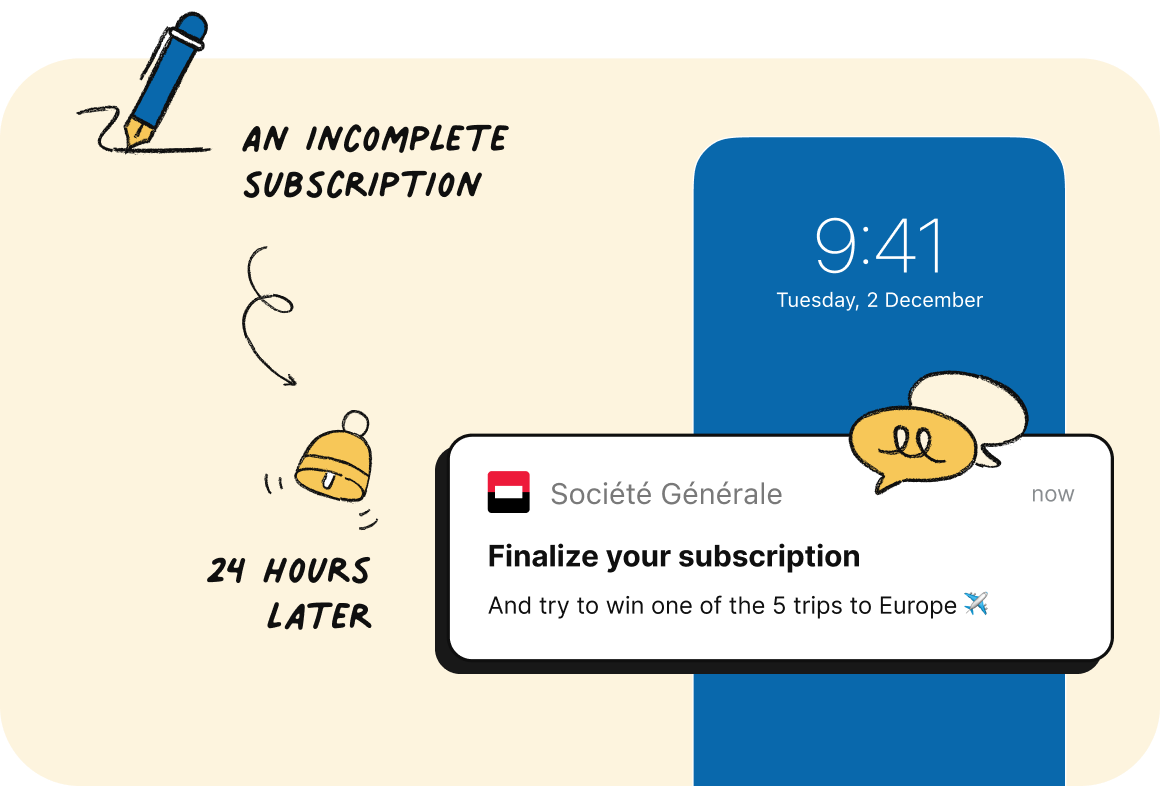

Harness signals from data to be used to generate better engagement: abandoned form reminders, limited offers, cross-selling, etc.

The support from Batch teams deserves a 5 star rating

Whatever the channel used, email or online chat, answers are always very clear and very fast.

Why do banks and insurance companies choose us?

- 38 %

- The average click-through rate of Batch's banking & insurance clients for their re-engagement campaigns

- 96 %

- The average opt-in rate on Batch's banking and insurance clients' Android apps (60% for iOS).

- 1 million

- This is the number of pushes/second that the Batch platform can produce for a deliverability rate in excess of 99%

With Batch, generate trust at all stages

Before subscription : Take care of onboarding, reassure, activate and engage

Conversion : Fine-tune your pipeline of sales opportunities, Offer the most relevant offers at the right time

After subscription : Manage customer loyalty by diversifying your approaches and content, Offer tailor-made cross-selling offers

Design new, more accurate and effective interactions

Truly custom content: use, harness and enable all of your customers' data to deliver unique, relevant experiences.

Contextual one-to-one marketing: trigger interactions based on your customers' behaviour on your app and/or website.

Cross-channel retargeting: engage your customers to act across all your channels.

Get a Demo.

Connect with us & try Batch for free.

Mention LégalesCopyright Batch © 2026